No place like home?

Some city residents could have lost their water; others lost their apartments. What has some tenants feeling left out to dry?

Residents at three apartment complexes in Mount Pleasant came home to some disturbing news earlier this year: Their water bill, which they paid with their rent, was overdue and the city could cut off sewage and water connections.

It was their housing managment company, Millennia, that missed their due date to pay the water bills to the city twice in six months.

Millennia is based in Ohio and owns Oxford Row, Canterbury Apartments and Winchester Towers in Mount Pleasant, which were affordable housing. But they are no longer that either, after the Department of HUD debarred the management company. That means it no longer accepts goverment subsidy for housing.

To avoid the missed payments again, the city of Mount Pleasant is drafting a new utility policy for apartment complexes with 20 or more units that have overdue water bills.

What is the new utility billing policy?

City manager Aaron Desentz said that the new utility billing ordinance is being drafted right now, with input from the city commissioners. He estimates that the city commission will see it again in September and vote on it in October.

If approved by the commission, Desentz said this new policy will be enacted after 30 days, which means it could potentially take ahold in November.

The draft reads that if a management company with more than 20 units within their apartment complex is late twice on its utility bills, the city requires a deposit.

That deposit equals three months’ of the average utility bill usage at that complex and will be put on file with the city, he said.

If the company is late a third or a fourth time, the city is able to use the deposit to pay those utility bills, Desentz said.

“This ensures that the individuals who live at that complex would not see their utility bills shut off, and this is in the event where the renter is paying the management company the utilities, as part of their rent,” Desentz said.

Meanwhile, the company that is late on their payments will still have a graduated late fee penalty. The current policy is that the late charges are 5%, but it will increase to 10% and 1% for each month they are late afterwards, Desentz said.

But he said if they are on time for the next 18 months afterwards, they would no longer have to have the deposit on file or be subjected to the fee.

“The whole point of the ordinance that is being crafted here is to make sure that people are able to stay within the homes that they have with very minimal disruption,” Desentz said. “I think the policy overall is a good policy.”

Desentz said the city decided to act on this issue because this management company has had issues around the United States.

“This situation being fairly unique, yet something we anticipated could cause future problems,” Desentz said. “We crafted a policy very much dedicated to that specific situation.”

Desentz did not mention the name of the management company because he said he hopes the company’s “rough patch” is just temporary and things will get better.

But, according to the city website, there are several past due and water shut off notices in the utilities billing information at 40 addresses of apartment complexes, owned by Millennia Housing Apartments.

For example, at 1501 Portabella, which is Oxford Row I, the past due notices were sent on March 20 and April 18, and the bill was adjusted with a door tag fee on May 7.

Similarly, at 1513 Portabella, which is also Oxford Row I, there were other past due and water shut off notices on Jan. 9, May 7 and June 20.

At 1518 Canterbury Trail, which is Canterbury East, there were also water shut off and past due notices on January 9, March 20 and April 18.

In a written statement from Millennia Companies’ PR representative Isys Caffey-Horne said that the two instances of the water shut off notices their residents received were payment errors by the third-party billing company. They are also now up-to-date with their utility payments.

“These delays did not result in any disconnection of water utilities or fines from the city, and the matter has been addressed with the property’s vendor,” Caffey-Horne said. “In each case, the management team quickly communicated with residents to avoid unnecessary concerns.”

How did the shutoff notices affect tenants?

Amanda Brake is the Mount Pleasant Housing Commission (MPHC) Section 8 Coordinator. Section 8 is the income-based subsidy vouchers for housing.

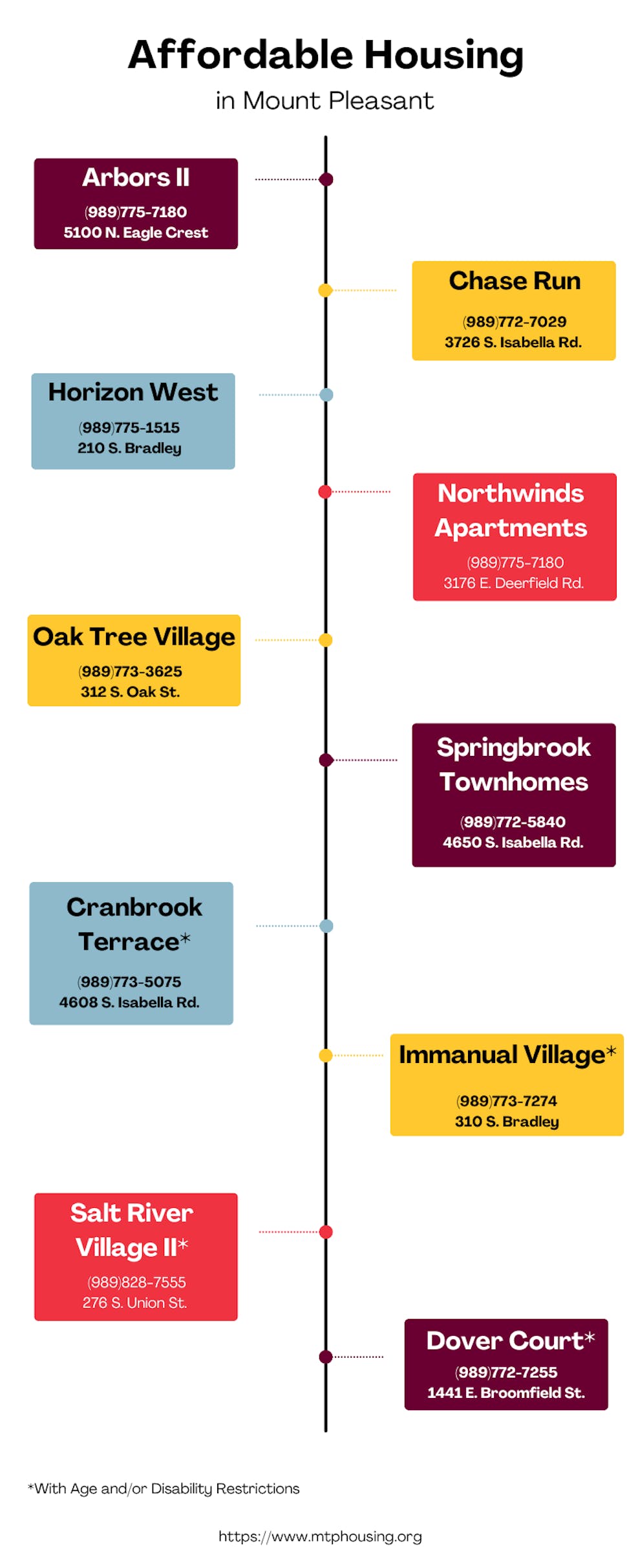

Brake said there are 13 local landlords in Mount Pleasant who accept the vouchers. There were three main apartment complexes that the MPHC worked with, such as Chase Run, Listening Ear and Oxford Rows, but they are no longer working with Oxford Rows as of today.

“My families were calling me, being furious,” Brake said. “I’ve got 10 families that are over there (in Oxford Rows and Canterbury). Not all of the buildings actually received a water shutoff notice. So there were some of my tenants that did not, and some of them did. And, of course, the first time it happened, I was like, ‘there’s no way.’”

But the notice was real. And it happened again.

“The second time it (happened), I had more families calling me, they were absolutely livid,” Brake said. “When they called to check on how much was owed, it was over $30,000 in water bills that had not been paid.”

Brake said now she is relocating multiple tenants from Millennia-owned apartment complexes in Mount Pleasant.

“It’s difficult, and it provided an entirely new difficulty to the situation of housing and assistance and relocation for sure,” Brake said.

But the water shut off notices are not the reason for relocation.

Last year, HUD started an investigation into Millennia because they received many complaints about quality control and maintenance, Brake said.

The Mississippi Free Press reported that a woman and her 5-year-old daughter died in the Millennia-owned Sunset Village in Cleveland, Mississippi, from a gas leak in 2022.

In Memphis, Tennessee, Fox 13 reported in 2023 that in Hope Hights, owned by Millennia, disabled tenants couldn’t leave their apartments for weeks, because the elevator wasn’t working.

In Kansas City, elderly residents in Gabriel Tower, owned by Millennia, hadn’t had heat during this past January, KCTV Channel 5 reports. According to National Weather Service, temperatures in Kansas City in January average about 38 degrees Fahrenheit.

In Kansas City, elderly residents in Gabriel Tower, owned by Millennia, hadn’t had heat during this past January, KCTV Channel 5 reports. According to the National Weather Service, temperatures in Kansas City in January average about 38 degrees Fahrenheit.

HUD came up with a decision to debar, which means to forbid the company from entering into federal contracts. Therefore, Millennia stopped taking the federaly funded Section 8 vouchers.

According to the U.S. General Services Administration website, the HUD’s decision is active from Dec. 14, 2023, to Dec. 13, 2028.

Brake said the MPHC stopped doing business with them. The residents are able to finish their lease with Section 8 vouchers, but they will not renew.

There are 10 tenants that Brake has to relocate; some of them are elderly and lived in their apartments for over 20 years.

Residents in Millennia-owned apartments did not reply to several attempts to reach them.

“It’s a big blow to lose them as a community partner to be able to get our families housing,” Brake said. “I’ve been working really hard on bringing new landlords in to accept the vouchers.”

Caffey-Horne from Millennia wrote in a statement that Millennia Companies have been providing affordable housing with more than 20,000 units across the U.S. for nearly 30 years.

“Many of these communities were in deep disrepair due to historical neglect by previous owners, and through its work,” she said. “The Millennia Companies sought to revitalize these properties to provide safe, decent and sanitary homes in accordance with HUD guidelines.”

But Caffey-Horne said now Millennia is in the process of selling the majority of its affordable housing properties.

“The Millennia Companies is thankful for its decades of partnership with HUD and looks forward to facilitating a smooth transition in partnership with HUD and the future buyer,” Caffey-Horne said in a statement.

A national problem of affordable housing

MPHC’s Brake said the Section 8 vouchers are great things and they provide housing relief for low-income families.

She said they let people live in the place of their choice, and they get a coupon that pays a part of their rent.

But not everything is that easy. Brake said the number of vouchers is limited. Isabella County has 54 vouchers, she said, and the waitlist to be offered one can take about five years.

Michigan State Housing Development Authority Communications Director Katie Bach said in a written statement that the current Section 8 waitlist is closed, but when open, it prioritizes applicants who are homeless.

She said MSHDA saw an increase in those applications.

To qualify for the Section 8 voucher, Brake said, a tenant must be at or below 50% of the poverty level. According to 2024 HUD poverty limits, a one-person household is considered low-income if they earn $44,600. They are considered very low income is they make $27,900.

Bach said the family is required to pay at least 30% of its adjusted monthly income toward their portion of the rent and utilities, and the voucher covers the rest.

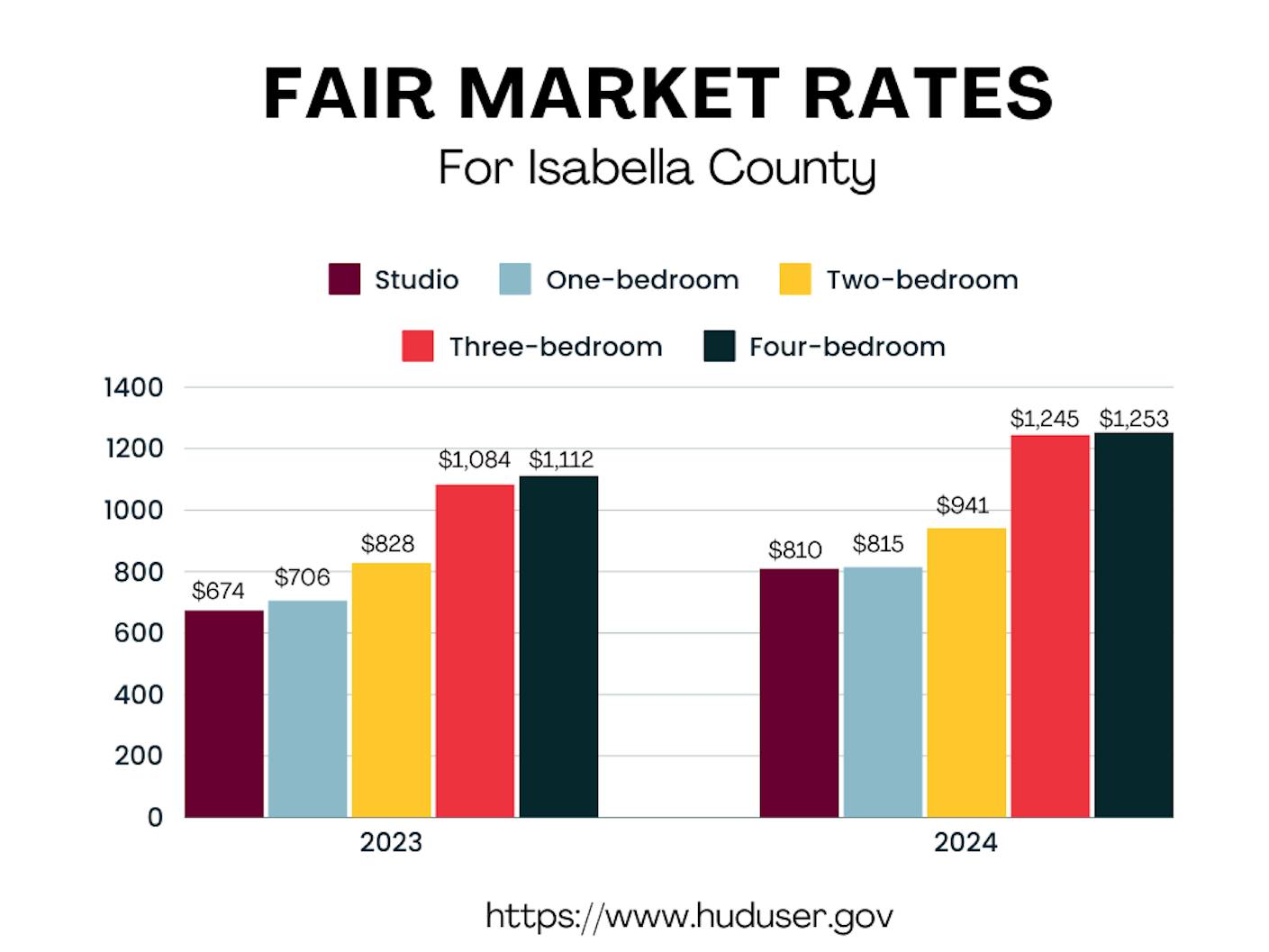

Each year, HUD publishes a fair market rate, which the MPHC uses to determine how much the voucher is going to pay, Brake said.

“Is that actually affordable?” she said. “That is definitely up for debate. And I would say, no, it’s not. The majority of the rents ... are astronomically higher every time they raise rates, in comparison to the income that our folks are receiving in the community. So rents are not affordable.”

Brake said they are seeing the lack of affordable housing issue all around the United States. One of the things that’s causing it are corporate landlords who are buying single-family housing and increasing the rent.

Desentz said the new utility billing policy will not affect rent prices in Mount Pleasant.

“The policy was very much crafted for, call it ‘bad behavior’ if you will, and so I don’t think this is going to have any other impact on any other property owners out there ... unless they find themselves late on paying utilities for 20 or more units within a 6-month period,” he said.

Brake said she hopes that Millennia will get it together, and this situation will not happen again.

She also said it is important that the residents have different housing opportunities and are now confident in their choices. She said other landlords helped her relocate the residents, and churches volunteered to help with move ins.

“I want to see there be more affordable housing,” Brake said. “I would love for there to be a requirement that every landlord take a voucher, because we have awesome folks that, they’re lower income, but they’re incredible residents.

“I wish all communities had more of an openness and a willingness to work with vouchers and to get our families housed.”

Bach said that having an affordable place to live is a foundation for success in life.

“When individuals and families have housing stability, they tend to do better in other aspects of their lives, from education, health, nutrition and work,” she said in a written statement. “When housing is stable it increases opportunities for economic mobility, and it lessens stress on families and frees up funds for other basic needs.”